This analysis is released in tandem with IHS's new report Patterns of Lost 2 to 4 Buildings in Chicago and reviews data on key characteristics of Chicago’s 2 to 4 unit housing stock to highlight the unique and critical role that these buildings play in Chicago’s housing landscape. Previous IHS analysis has illustrated the importance of 2 to 4 unit buildings in Chicago’s rental market and highlighted the relationship between declines in the 2 to 4 unit rental stock and losses in Chicago's overall affordable rental supply. Recent IHS research has further documented the overall loss of 2 to 4 unit buildings in Chicago and how market forces related to both gentrification and disinvestment are putting pressure on this stock in different parts of the city.

Affordable housing experts and practitioners note that 2 to 4 unit properties, often owned by small “mom and pop” landlords, fall through the cracks due to the lack of federal policies and tools aimed at these small rental buildings, and it is likely that the COVID-19 pandemic will put additional pressure on the 2 to 4 housing stock. Research both locally and nationally has shown that lower-income renters have been the most affected by the economic impacts of the pandemic. While government interventions to provide enhanced unemployment benefits, funds for rental housing assistance, and eviction and foreclosure moratoria have prevented some worst-case scenarios from coming about, there are still substantial warning signs that, as with the Great Recession, 2 to 4 unit properties will be uniquely and disproportionately impacted.

To inform ongoing policy conversations related to the preservation of 2 to 4 buildings in Chicago neighborhoods, this analysis updates key contextual data on the stock of 2 to 4s in Chicago and includes new data on the characteristics of the stock, its role in providing affordable rental and family-sized housing, how the stock has been impacted by foreclosure, and the importance of 2 to 4s in communities of color and for households of color.

To complement the analysis below, a data appendix is included with this report that provides many of the data points by different geographic units of analysis including neighborhood race and ethnic composition*, market value, Chicago community area, and Chicago ward.

Key findings:

2 to 4 unit buildings represent a large portion of Chicago’s housing stock and have a substantial presence in some Chicago neighborhoods. Units in 2 to 4 unit properties represent 26 percent of Chicago’s housing stock, but in some communities, 2 to 4s make up the vast majority of properties. In neighborhoods like South Lawndale and Brighton Park, 2 to 4 unit buildings account for 70 percent or more of the residential housing units, and in a third of Chicago neighborhoods, 2 to 4 buildings are the most common type of housing. Key data on the characteristics of 2 to 4s in Chicago neighborhoods are mapped in the interactive map below and are included in the appendix here.

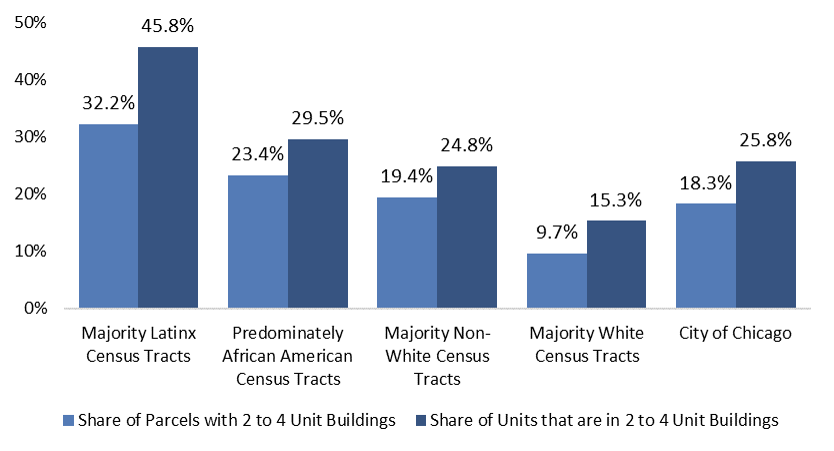

2 to 4 unit buildings are a particularly important component of the housing stock in Chicago's communities of color. Examining these data by the underlying race and ethnic composition of neighborhoods, the data show that the stock is especially important in Latinx neighborhoods. Figure 1 shows that 32.2 percent of all parcels and 45.8 percent of all residential housing units in majority-Latinx communities are in 2 to 4 unit buildings, compared to just 9.7 percent of residential parcels and 15.3 percent of units in majority-white areas. Two to 4 unit buildings are also an important part of the stock in predominantly African American and majority non-white communities, where 23.4 and 19.4 percent of parcels and 29.5 and 24.8 percent of units are in 2 to 4 unit buildings, respectively.

Figure 1. Share of Total Parcels and Total Units in 2 to 4 Unit Buildings by Neighborhood Race and Ethnicity Typology in the City of Chicago, 2020

Source: Cook County Assessor/IHS Data Clearinghouse

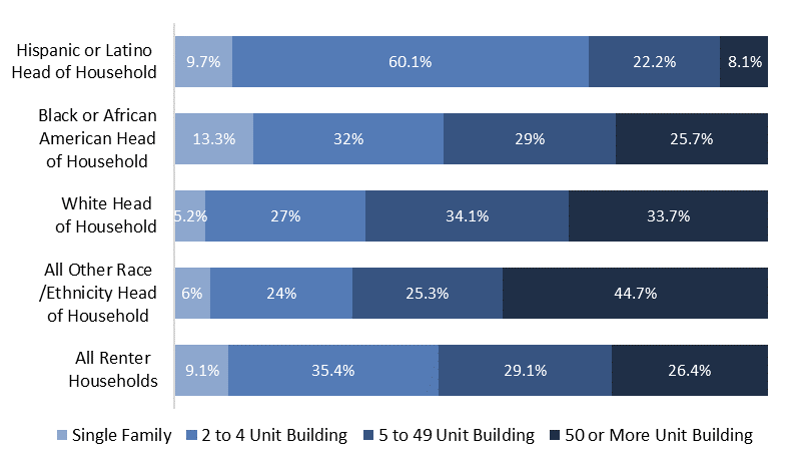

Chicago’s Latinx and Black renters particularly rely on 2 to 4 unit buildings. Nationally, data from Urban Institute finds that Black and Hispanic- or Latino-headed households are more likely to rent units in 2 to 4 unit buildings than any other type of structure. For Chicago’s renter households of color, and especially for Latinx renter households, 2 to 4 unit buildings are an important housing resource. Citywide, 73.4 percent of all rental units in 2 to 4s are occupied by households headed by a person of color. Figure 2 illustrates that as of 2019, 60.1 percent of all renter households headed by a person who identifies as Hispanic or Latino and 32 percent of all renter households headed by a person who identifies as Black or African American live in 2 to 4 unit buildings, compared to 27 percent of white renter households.

Figure 2. Composition of Renter Households by Head of Household Race and Ethnicity and Building Type in the City of Chicago, 2019

Source: American Community Survey 2019 1-Year PUMS

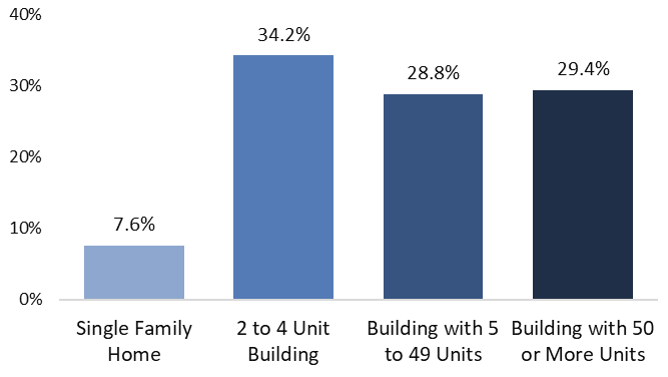

Rents in 2 to 4 unit buildings are typically more affordable than in other building types. National research has shown that small rental properties, particularly those with 2 to 4 units are a critical component of the “naturally occurring” affordable housing stock and are more likely to offer lower rents and serve lower-income renters. Figure 3 illustrates that these patterns hold true in Chicago, where 34.2 percent of rental units in 2 to 4 unit properties have rents below $900, a higher share than any other building type. Although these units represent an important affordable housing resource, IHS’s research has found that Chicago has lost 11,775 units in 2 to 4s from 2013 to 2019. Because the affordability of the 2 to 4 stock is in large part due to its age and ownership characteristics, once these units are gone, the affordable rents they once supported may be nearly impossible to replace.

Figure 3. Share of Rental Units with Rents below $900 by Building Size in the City of Chicago, 2019

Source: American Community Survey 2019 1-Year PUMS

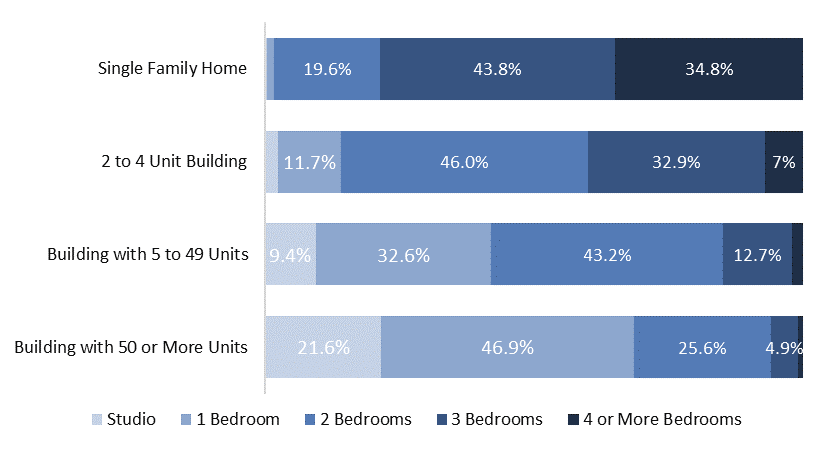

Compared to other traditional multifamily rental buildings, units in 2 to 4 unit buildings are more typically “family-sized” with a larger number of bedrooms. Figure 4 illustrates the composition of Chicago's rental stock broken out by the type of building and the number of bedrooms. It shows that nearly 40 percent of rental units found in 2 to 4s have three or more bedrooms compared to 14.8 percent in 5 to 49 unit buildings and 5.9 percent in buildings with 50 units or more. Newly developed market-rate or affordable units with three or more units are hard to come by, and preserving the 2 to 4 stock can maintain a variety of housing options for different household types, including families with children and intergenerational households. While affordable family-sized units in 2 to 4s are being lost due to market pressures or vacancy and demolition, less than 5 percent of the units in newly built affordable housing include family-sized units.

Figure 4. Composition of Chicago’s Rental Stock by Building Size and Bedroom Count by Building Type, 2019

Source: American Community Survey 2019 1-Year PUMS

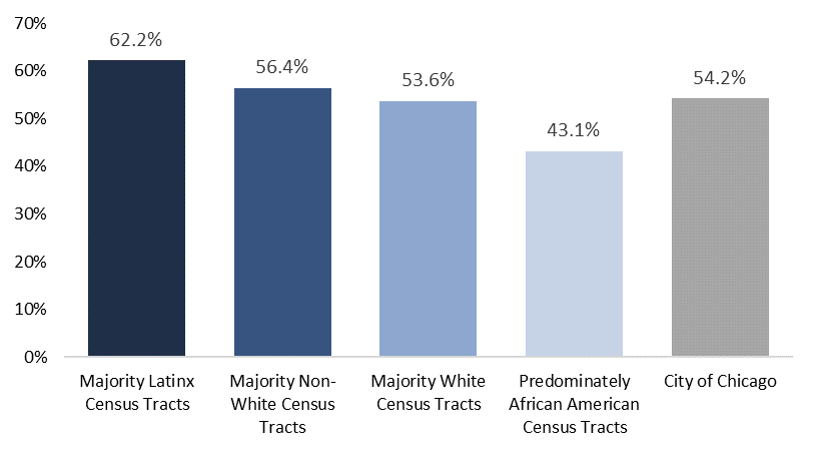

2 to 4s are frequently owner-occupied, particularly in majority Latinx communities. One of the unique characteristics of the 2 to 4 housing stock is that it offers both owner-occupied and rental housing opportunities and because owner-occupants are also able to rent out one or more of the units in their properties, these buildings present income- and wealth-building opportunities in addition to homeownership. According to data from the Cook County Assessor, roughly 54 percent of 2 to 4 unit buildings had an active homeowner exemption in tax year 2019 and are presumed to be owner-occupied. Historically, 2 to 4s have been a pathway for affordable homeownership, and that remains true today, particularly in Chicago’s Latinx communities. Roughly 62 percent of 2 to 4 unit properties in Chicago’s majority Latinx communities are likely owner-occupied. This is compared to 53.6 and 43.1 percent of 2 to 4s in majority white and predominantly African American communities, respectively. Figure 5 illustrates these data by neighborhood race and ethnicity and the appendix breaks out data by market type, City of Chicago community area, and City of Chicago ward.

Figure 5. Share of 2 to 4 Unit Buildings with Active Homeowner Exemptions by Neighborhood Race and Ethnicity Typology in the City of Chicago, Tax Year 2019

Source: Cook County Assessor/IHS Data Clearinghouse

Chicago’s 2 to 4 unit buildings represent a mix of building materials and styles and are generally the oldest buildings in a community. Along with the bungalow, small rental buildings with between 2 and 4 units are an iconic Chicago architecture style and contribute to Chicago neighborhoods' architectural and housing type diversity. Built primarily in the first few decades of the 1900s, the median age of 2 to 4 unit properties in Chicago is 108 years with only slight variation in age across Chicago neighborhoods. Two to 4’s are largely masonry construction, but significant portions of the stock in predominantly Latinx communities, roughly 45 percent, are frame construction or a mix of frame and masonry. Understanding the age and construction types of 2 to 4 buildings in Chicago neighborhoods highlights the different maintenance needs necessary to support the preservation of the stock. Figure 6 maps community areas in the City of Chicago and highlights key facts about neighborhoods and 2 to 4 unit buildings. Click on a community area to view data on the physical characteristics of the 2 to 4 building stock, the share of 2 to 4 residential units associated with a homeowner exemption, and the share of people of color in each community area. For a full-page version of the map, click here.

Figure 6. Interactive map of Physical Characteristics of the 2 to 4 stock in Chicago Neighborhoods

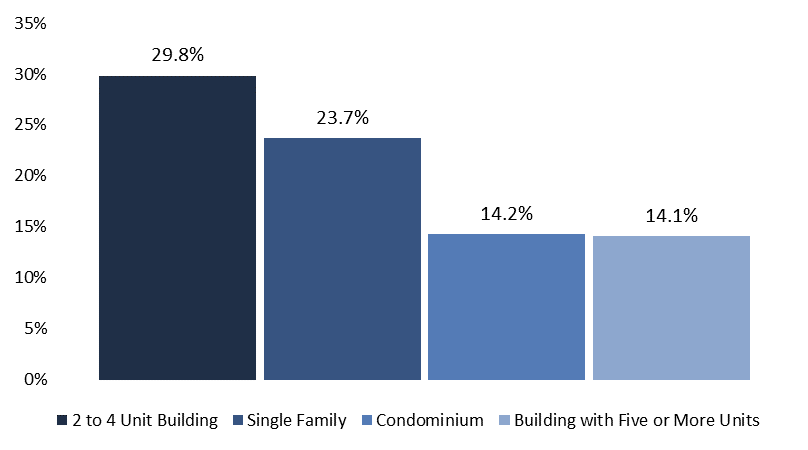

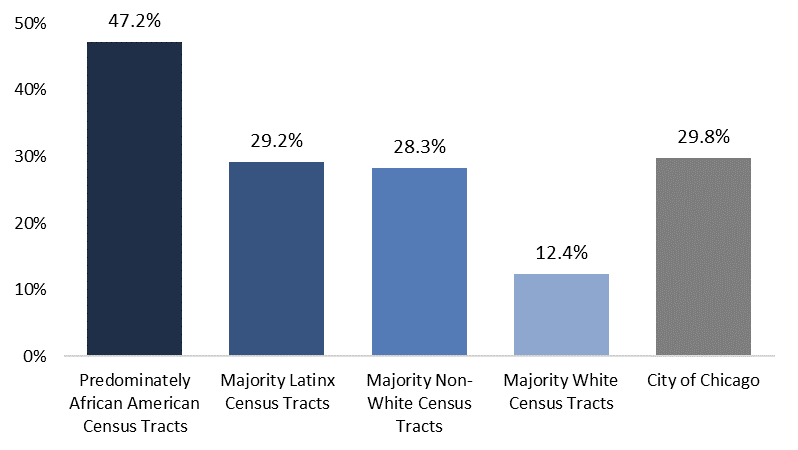

2 to 4 unit properties were heavily impacted by the foreclosure crisis and Great Recession, particularly in predominately African American communities. The impacts of the foreclosure crisis at the individual and community level include displacement and housing insecurity, declining property values and levels of home equity, and high levels of residential vacancy and demolition. Figure 7 illustrates that in Chicago, nearly 30 percent of all 2 to 4 unit properties had at least one foreclosure filing between 2005 and 2019 the highest concentration of foreclosure distress of any property type. Examining the data by the underlying composition of neighborhoods by race and ethnicity, Figure 8 shows that accumulated foreclosure activity is highly concentrated in predominately African American neighborhoods in Chicago, where 47.2 percent of all 2 to 4 unit properties experienced at least one foreclosure filings during this period compared to 29.2 percent of all 2 to 4s in Latinx communities, 28.3 percent in majority non-white communities, and just 12.4 percent of all 2 to 4s in predominately white neighborhoods.

Figure 7. Share of Parcels with at Least One Foreclosure Filing by Property Type in the City of Chicago, 2005-2019

Source: IHS Data Clearinghouse

Source: IHS Data Clearinghouse

Figure 8. Share of 2 to 4 Parcels with at Least One Foreclosure Filing by Neighborhood Race and Ethnicity Typology in the City of Chicago, 2005-2019

Source: IHS Data Clearinghouse

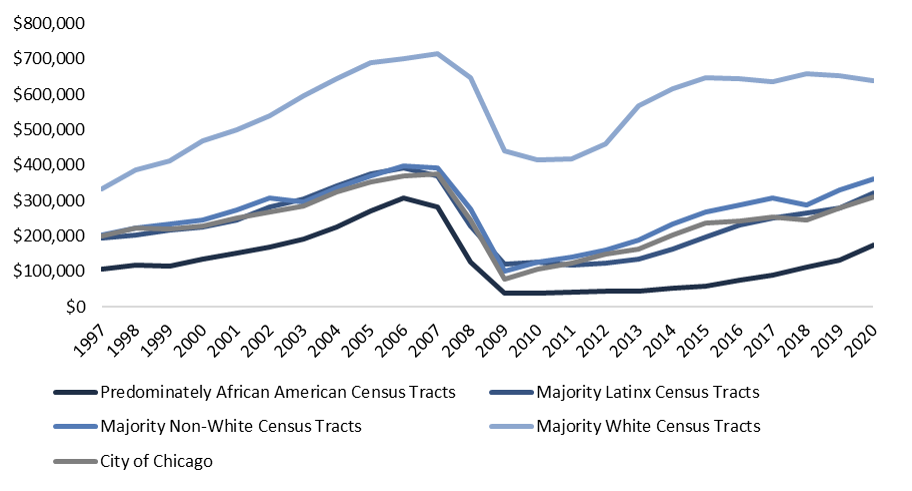

Citywide, there is significant variation in sales prices and price levels generally have not yet recovered to pre-Great Recession levels. A history of segregation, disinvestment, and more recently the lingering impacts of the foreclosure crisis have impacted the ability of 2 to 4 unit property owners to build wealth in communities of color, particularly in Chicago’s African American communities. Figure 9 charts the inflation-adjusted median sales prices for 2 to 4 unit buildings from 1997 to 2020 by the underlying race and ethnic composition of Chicago neighborhoods. In 1997, a typical 2 to 4 unit building sold for $105,573 in a predominantly African American community, $194,555 in a predominantly Latinx community, and $331,800 in a predominantly white community. At the respective bottom of the market during the foreclosure crisis in each area, the average 2 to 4 unit building sold for approximately $38,324 in a predominantly African American community, $117,931 in a predominantly Latinx community, and $415,296 in a predominantly white community. Prices have also been slowest to recover in communities of color as owners of 2 to 4s in these communities have seen the lowest long-term price growth. In predominantly African American communities and Latinx communities, 2 to 4 unit building prices have grown to $175,000 and $322,000, respectively, or by roughly 65.5 percent from 1997 to 2020. In comparison, a typical 2 to 4 unit property in a predominantly white community has grown by 92.5 percent during this same time period and reached a median sales price of $638,750 by 2020 - more than double Chicago’s 2 to 4 unit median sales price of $310,000.

Figure 9. Median Sales Prices for 2 to 4 Unit Properties by Neighborhood Race and Ethnicity Typology in Chicago (2020 Inflation-Adjusted Dollars), 1997-2020

Source: IHS Data Clearinghouse

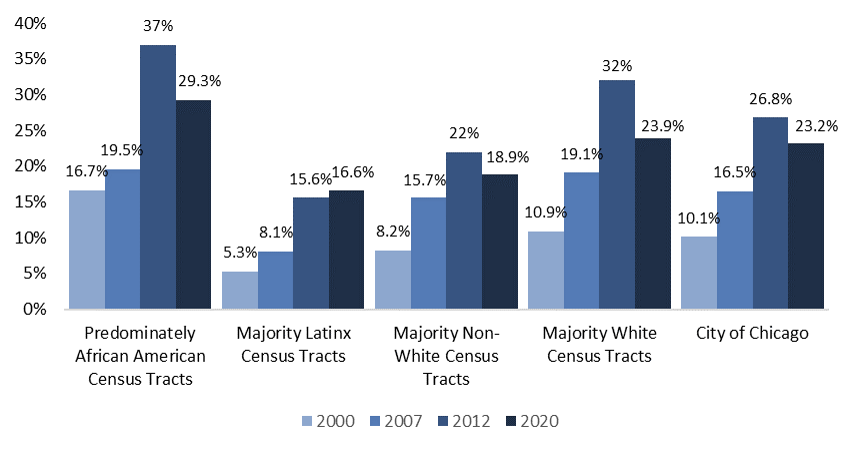

Predominately African American communities have seen a higher share of 2 to 4s purchased by investors. During the aftermath of the foreclosure crisis, investors bought up thousands of foreclosed or distressed properties. Although the share of 2 to 4 properties purchased by business buyers in predominantly African American communities reached a high of 37 percent at the bottom of the market in 2012, Figure 10 shows that investors played an outsized role in these communities’ housing markets before the Great Recession. This trend remains prevalent in Chicago’s communities of color today. In 2020, business entities bought nearly 30 percent of 2 to 4 unit properties in predominantly African American communities. Although business buyers played a smaller role in Latinx communities before and during the foreclosure crisis, their presence has steadily increased even as the share of 2 to 4s purchased by these entities has fallen since 2012 in all other communities.

Figure 10. Share of 2 to 4 Unit Properties Purchased by Investors by Neighborhood Race and Ethnicity Typology in the City of Chicago, 2000-2020

Source: IHS Data Clearinghouse

Discussion

This analysis highlights the critical and unique role that 2 to 4 unit properties play in Chicago neighborhoods and illustrates that across Chicago and particularly in Chicago’s communities of color, 2 to 4 unit properties provide affordable rental and ownership options. Due to the importance of the stock, the disappearance of these buildings in parts of the city due to market pressures, the lingering impacts of the foreclosure crisis, and potentially the COVID-19 economic downturn may have long-term impacts on housing affordability in Chicago.

Developing additional strategies to preserve the 2 to 4 stock is essential to addressing broader policy goals around creating and preserving affordable rental housing, expanding homeownership and wealth-building opportunities for households and communities of color, and stabilizing lower-income renters and small landlords in the wake of the COVID-19 economic downturn. Local Chicago organizations and policymakers have a long history of working to preserve this stock in different communities. In communities that saw high levels of vacancy after the foreclosure crisis, The Preservation Compact created a loan product that provides low-cost financing for property owners to rehabilitate their 1 to 4 unit buildings, keeping these rentals affordable. Recently, Chicago's City Council passed policies to discourage the demolition and conversion of the 2 to 4 stock in Pilsen and neighborhoods around The 606 trail that are experiencing affordability pressures. IHS is continuing to work with non-profit partners citywide to provide data and technical assistance around efforts to preserve and promote investment in the 2 to 4 unit stock. To learn more about different proposed solutions to address these issues, read The Need for a Collective Approach to Preserving 2 to 4 Unit Housing in Chicago authored by a collaborative group of organizations including Enterprise Community Partners, Communities United, Neighborhood Housing Services of Chicago, Greater Chatham Initiative, Garfield Park Community Council, New Covenant CDC, and Elevate Energy.

* Census tract racial and ethnic composition uses data from the American Community Survey on a population to characterize census tracts. Predominately African American neighborhoods are census tracts where 80 percent or more of the population is Black or African American, Majority Latinx neighborhoods are census tracts where more than 50 percent of the population is Hispanic or Latino, Majority non-white neighborhoods are where more than 50 percent of the population is non-white, and Majority white neighborhoods include census tracts where more than 50 percent of the population is white.