This update of the Institute for Housing Studies (IHS) Cook County House Price Index highlights changing prices for single-family homes through the fourth quarter of 2016 in 16 City of Chicago submarkets and 17 submarkets primarily in suburban Cook County. A detailed discussion of the Index is below. To view a full page interactive graph with a map and data for all submarkets go here. Underlying price index data can be found here.

Key Findings

Year-over-year price changes

- Areas with the largest increases in prices between the fourth quarters of 2015 and 2016 include Chicago submarkets Humboldt Park/Garfield Park, Logan Square/Avondale, and South Chicago/West Pullman where price levels increased by 21.5 percent, 13.2 percent, and 13.2 percent respectively. These three areas are very different in many ways. House prices in Humboldt Park/Garfield Park experienced a significant crash during the housing crisis, but have also seen the strongest rebound during the recovery. Logan Square/Avondale is a market that has seen substantial long-term price appreciation in addition to strong short-term price gains. Conversely, South Chicago/West Pullman is an area that experienced dramatic price declines during the market crash and previously had seen a rather weak recovery.

- Areas experiencing some of the slowest year-over-year price changes are higher-value, stable submarkets like north suburban Winnetka/Northbrook and Chicago submarkets Lincoln Park/Lakeview and Uptown/Rogers Park. All of these areas experienced annual price increases of less than two percent.

- The average Cook County submarket experienced a 6.3 percent increase in prices compared to the previous year. In the City of Chicago, the average submarket experienced an 8 percent increase, and in suburban Cook County prices in the average submarket increased by 5.4 percent.

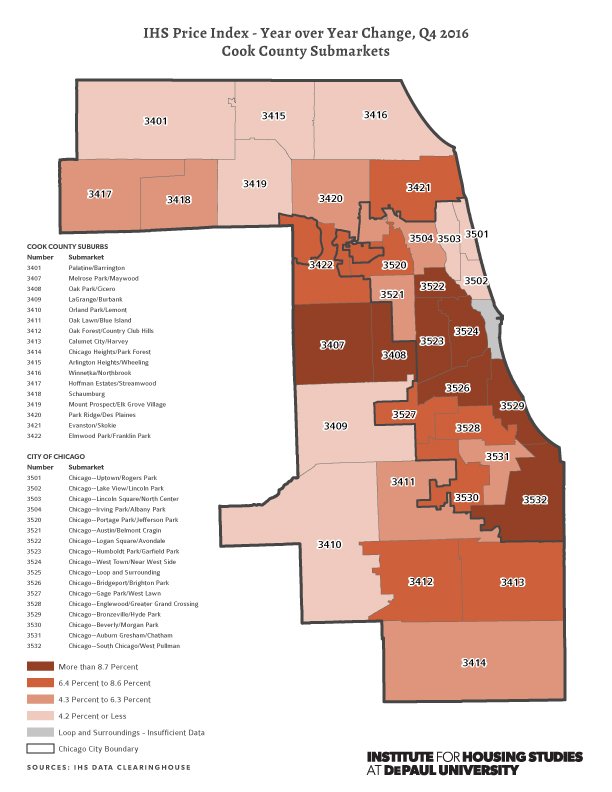

- The map below highlights the pattern of submarkets that have seen the largest and smallest year-over-year price increases. It shows that areas with the biggest annual price increases are on the south side along Lake Michigan, and north and northwest near downtown Chicago. The smallest increases are seen in high-value northside Chicago neighborhoods and in parts of north, northwest, and southwest Cook County. A PDF version of the map below can be found here.

Year Over Year Change, Q2 2016 Cook County Submarkets

Year Over Year Change, Q2 2016 Cook County Submarkets

Peak to current

- As of the fourth quarter of 2016, four City of Chicago submarkets Logan Square/Avondale (10.8 percent), West Town/Near West Side (9.6 percent), Lincoln Square/North Center (6.3 percent), and Lake View/Lincoln Park (3.1 percent) had exceeded previous peak price levels seen during the height of the housing bubble. All other submarkets remain below their bubble-era peaks.

- Despite recent price improvements, Englewood/Greater Grand Crossing continues to be the submarket furthest from its bubble-era peak with prices 54.3 percent lower than they were at the top of the market as of the fourth quarter of 2016.

- Compared to the peak of the market, prices in the median Cook County submarket are still off by 20.3 percent. Prices in the median City of Chicago submarket are 23.4 percent less than they were at peak levels, although there is substantial variation between City of Chicago submarkets. In suburban Cook, prices in the median submarket are 18.6 percent off peak levels.

Recovery from bottom

- As of the fourth quarter of 2016, all submarkets in Cook County have experienced at least a 14 percent price increase compared to their lowest post-recession price levels. Areas with the largest increase from price bottom include Humboldt Park/Garfield Park and Logan Square/Avondale. These areas both have single-family house prices that are 92.7 percent and 72.8 percent higher than their price bottoms, respectively.

- The weakest recoveries have been seen primarily in suburban Cook County. This is largely due to the suburbs being less volatile housing markets with less dramatic price peaks and valleys than many City of Chicago submarkets. The suburban area with the weakest recovery is south suburban Orland Park/Lemont where prices increased by just 14.7 percent from its price bottom.

- House prices in the median Cook County submarket have recovered by 32.7 percent since the bottom of the market. In the City of Chicago, the median submarket has seen prices rebound by 43.7 percent compared to 29 percent in suburban Cook.

Price changes since 2000

- As of the fourth quarter of 2016, two Cook County submarkets continue to experience price levels below their year 2000 price levels. Prices in suburban Calumet City/Harvey were 14 percent less than levels in the year 2000, while price levels in suburban Chicago Heights/Park Forest were over 3.9 percent below prices in 2000. In the City of Chicago, the Auburn Gresham/Chatham submarket had the lowest prices relative to year 2000 with prices in the fourth quarter 2016 just 9.3 percent higher.

- Price levels in three Chicago submarkets were more than 120 percent what they were in 2000 as of the fourth quarter of 2016: West Town/Near West Side (158.8 increase from 2000 levels), Logan Square/Avondale (155.6 percent above 2000 levels), and Lincoln Square/North Center (122 percent from 2000 levels).

- House prices in the median Cook County submarket have increased by 54.6 percent since 2000. In the City of Chicago, prices in the median submarket have increased by 66.4 percent compared to 48.1 percent in suburban Cook.

To view a full page interactive graph with a map and data for all submarkets go here. Underlying price index data can be found here.

Background on Price Indices

House price trends are one of the most important indicators of a neighborhood’s economic health, and understanding how these trends vary within the City of Chicago and suburban Cook County is critical to those working to develop policies and investment strategies sensitive and responsive to local market dynamics and household financial conditions. To help housing stakeholders, policymakers, and the public understand this issue better, the Institute for Housing Studies (IHS) has developed a submarket-level Cook County house price index to track quarterly price trends for single family homes in 16 submarkets in the City of Chicago and 17 submarkets in suburban Cook County. In recent years, substantial focus has been paid to the importance of house price trends as a national or regional indicator of economic conditions, but growing attention is being paid to the implications uneven price declines and recoveries across neighborhoods have for communities and their residents. Neighborhoods with rapidly rising prices may be those facing current or future housing affordability concerns, while areas with slow price recovery may need strategic investment to rebuild demand for housing. Additionally, the uneven nature of house price declines and recovery across neighborhoods is a stark illustration of the growing divide between thriving and struggling communities and households. Home equity is one of the key vehicles for families to build wealth, and the variation in price trends can be an indicator of household financial conditions across communities measured by the level of home equity gained and lost by households and neighborhoods over time.

More About IHS' Cook County Submarket Indices

The submarkets in IHS’s price index are based on Public Use Microdata Areas (PUMAs) from the 2010 US Census. There are 16 submarkets in the City of Chicago and 17 that are primarily in suburban Cook County. In the City of Chicago, the submarket surrounding the Loop has been excluded because of insufficient levels of single family home sales. Click here for a reference guide to the community areas and suburban municipalities found in each submarket. Additional detail about the model can be found at the end of this analysis.

The discussion below highlights four key metrics for analyzing house price trends and describes their patterns and their implications for communities:

Year over Year – This metric illustrates the short-term price trend and compares the current price level as of the second quarter 2016 with the price level in the second quarter 2015. Areas with large changes in price levels tend to be a mix of markets with recent increased demand. These include highly foreclosure distressed areas where prices are starting to recover, and rapidly appreciating “hot” markets. Historically strong markets tend to have low but steady appreciation year over year. Interpreted in conjunction with other price trend indicators, year over year price changes can be helpful in identifying rebounding markets with stabilizing prices.

Recovery from Bottom – This metric measures the change in price level from a submarket’s lowest point after the 2008 collapse of the housing market to the second quarter of 2016. It tracks the speed of recovery of single family house prices from the point that prices in that submarket reached their recent lowest price level. This indicator is an important measure for recent buyers who purchased properties near the bottom of the market and who are trying to understand the return on that investment. It is also a valuable indicator for understanding where investment has been flowing in recent years. This “recovery” metric is a product of recent demand for housing outstripping the supply of homes for sale in these areas. This demand could be driven by owner occupants competing for a limited supply of for-sale housing in “hot” markets or investors competing for the dwindling supply of low-cost properties in more distressed markets. This recovery metric should be interpreted in conjunction with other price trend data points, however.

Peak to Current –This metric measures the difference between a submarket’s peak price level at the height of the housing boom and the current price level as of the second quarter of 2016, and it captures the recovery of a neighborhood’s house prices towards previous price peak levels. Often, neighborhoods that saw a substantial build up in prices during the housing bubble experienced equally dramatic declines. While those price peaks were often inflated and unsustainable, recovery towards those peaks is an important benchmark for homeowners who bought their homes or obtained a mortgage from 2005 to 2007 when prices were at their highest.

Many homeowners are reluctant to sell their homes for less than what they paid, and, in cases where a mortgage is involved, areas that are well below previous peak values are likely to have larger numbers of underwater or near-underwater homeowners. As values get closer to previous peak levels, more homeowners are likely willing and able to sell, more households will exit underwater status, and equity lost during the housing crisis is rebuilt. In areas where values remain well below peak levels, many homeowners likely remain underwater. Owning more on a mortgage than what a property is worth limits an owner’s ability to sell their property and puts a greater strain on a household’s financial conditions.

Price trends since 2000 – This metric tracks the change in price levels from the first quarter of 2000 to the second quarter 2016 and measures long-term price trends. The variation in neighborhood price trends since 2000 is a key indicator of the impact the housing crisis and uneven housing recovery has had not just on local housing markets, but also on long-term homeowners. Home equity is a key asset for both lower- and higher-income households, and increasing equity over time is one of the ways that both lower- and higher-income households build wealth. Areas where there has been limited long-term price appreciation are areas where long time owners benefit less from increasing home equity compared with long-term owners in areas with significant appreciation.

The Model

Using its data clearinghouse, IHS has developed a hedonic price index model to provide a stable mechanism to track submarket-level price trends. Unlike a repeat sales model which requires a matched pair of sales on a single property and can be less stable at smaller geographies, a hedonic model combines data on a property’s sales price with data on the physical characteristics of that property and its location relative to key amenities or disamenities. The statistical model controls for factors that contribute to price and allows for the development of an index tracking price changes of the typical, non-distressed home over time and is ideal for tracking price trends at the submarket level.

Click here for more information on IHS’s hedonic price index model.