The report highlighted below overviews a recent collaboration between IHS and Urban Institute to examine key data supporting a local initiative to identify strategies needed to expand access to homeownership and wealth-building opportunities for Black and Latinx households, protect current homeowners of color, and preserve the existing affordable housing stock in Chicago. To view a copy of the report, Chicago Housing Overview: Preserving Affordability and Expanding Accessibility, click here.

Background

For many households, home equity is a major component of overall household wealth. This is especially true for Black and Latinx households that hold a greater share of their wealth in their homes.

While homeownership plays a large role in wealth building for households of color, gaps in homeownership rates by race and ethnicity persist. The legacy of discriminatory housing policies and lending practices has resulted in unequal access to homeownership among people of color. More recently, the disproportionate impacts of the 2008 Great Recession reversed homeownership gains made by Black and Latinx homeowners, many of who were also first-time homeowners, during the 1990s and early 2000s. Additionally, uneven recovery during the post-Recession period has limited house price appreciation and wealth building in some communities of color.

Today, the racial homeownership gap continues to be the largest contributor to the racial wealth gap. The national homeownership rate for Black households has remained virtually unchanged since the passage of the 1968 Fair Housing Act. In Chicago, homeownership rates for Black and Hispanic families are 35 percent and 43 percent, respectively, compared with 54 percent for white households. These inequities may widen as communities of color experienced greater public health impacts and economic losses as a result of the COVID-19 pandemic.

The Collaboration

In response, the Chicago Community Trust launched its Protecting and Advancing Equitable Homeownership initiative as part of its Growing Household Wealth strategy. The Trust convened Chicago housing experts, practitioners, and advocates throughout 2020 to explore policies, strategies, and best practices to reduce existing homeownership gaps in the Chicago region.

As part of this initiative, the Institute for Housing Studies (IHS) and the Urban Institute developed data and analyses to support conversations among a cohort of eight organizations around strategies needed to expand access to homeownership and wealth-building opportunities for Black and Latinx households, protect current homeowners of color, and preserve the existing affordable housing stock in Chicago. Throughout 2020 and 2021, IHS built and presented key data and analyses to Initiative partners. Many of these insights are summarized in Chicago Housing Overview: Preserving Affordability and Expanding Accessibility.

These organizations included Latin United Community Housing Association (LUCHA), the Chicago Area Fair Housing Alliance (CAFHA), the Lawndale Christian Development Corporation, the Brighton Park Neighborhood Council, Neighborhood Housing Services of Chicago, the Northwest Side Housing Center, Spanish Coalition for Housing, and Housing Action Illinois.

Chicago Housing Overview: Preserving Affordability and Expanding Accessibility

The data and analyses in this report can serve as a resource for Chicago policymakers, practitioners, and advocates by providing local data to expand access to homeownership and incorporate racial equity into housing programs, practice, and policy. The data are presented in four sections:

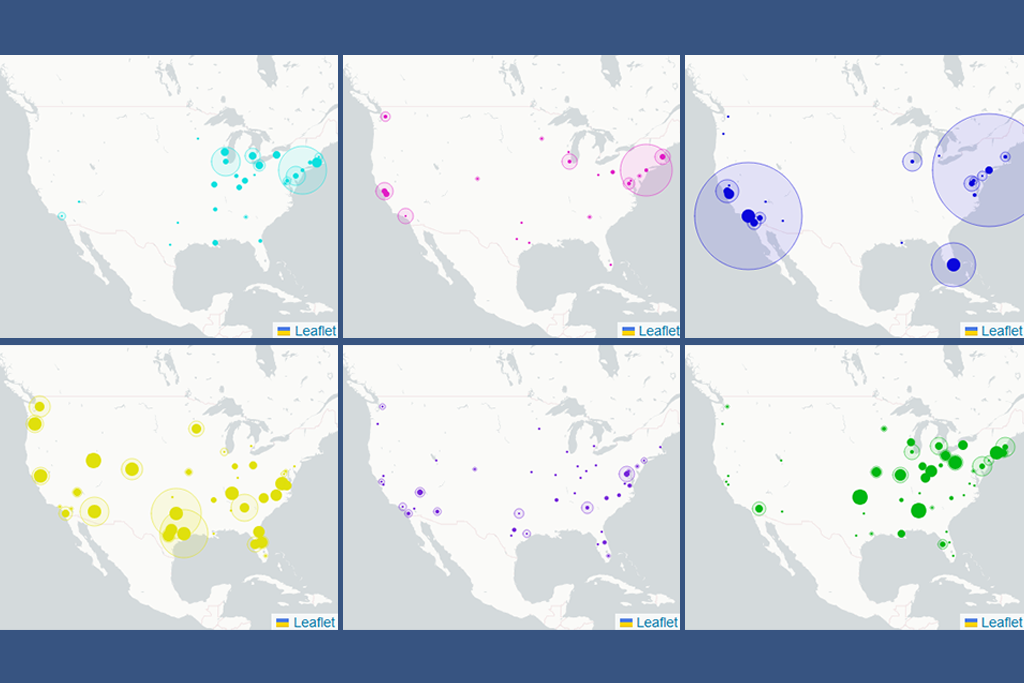

Racial and Ethnic Demographics. This section describes the city’s demographics, including the geographic distribution of residents and population and income trends. Despite roughly proportionate racial and ethnic representation citywide, communities of color remain highly concentrated in neighborhoods on the south and west sides of Chicago.

Pre-crisis and Post-crisis Housing Market Trends. The 2008 Great Recession had devastating impacts on Chicago homeowners, stripping significant home equity and pushing many households into foreclosure. Variation in the recession’s impact and the market recovery across neighborhoods amplified disparities in homeownership and wealth. This section tracks indicators from the recession into the recovery period and highlights how the crash changed Chicago’s housing landscape.

Recovery Drivers and Post-recession Impact. Chicago’s post-recession recovery has been slow and unequal, with home prices only recently returning to the pre-crisis peak in some communities. This section describes home price changes, by race and ethnicity, and shows how access to credit and buyer activity have changed since the recession.

Impact of the COVID-19 Pandemic. This section provides insight into the impacts of the COVID-19 recession on housing instability by looking at homeowners in forbearance while highlighting how strong price growth in communities of color during the pandemic may help some struggling families avoid foreclosure.

What's Next

IHS will continue to convene with another cohort of Chicago organizations through the Chicago Community Trust's Protecting & Advancing Equitable Homeownership initiative. These 11 organizations include The Resurrection Project, Resident Association Greater Englewood (R.A.G.E), Far South Community Development Corporation, Chicago Rehab's Center for Shared Ownership, LUCHA, Lawndale Christian Development Corporation (LCDC), Brighton Park Neighborhood Council (BPNC), Neighborhood Housing Services of Chicago (NHS), Northwest Side Housing Center, Spanish Coalition for Housing, and Housing Action Illinois.

Through the remainder of 2011 and through mid-2022, IHS aims to develop new and updated data indicators related to homeownership and investment in Chicago communities, provide technical assistance to stakeholders using this information in their work, and engage housing and community development stakeholders to understand critical questions, policy applications, and data needs.