By Jin Man Lee and Jin Wook Choi

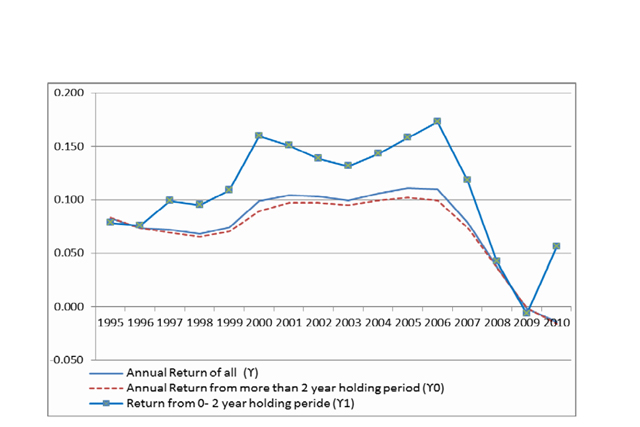

This working paper examines the impact that property flippers have on prices in local housing markets during both boom and bust cycles of the real estate market. The analysis focuses on single-family home sale transactions for Cook County, IL from 1995 to 2010. It shows that house price increases were particularly strong in Cook County between 2000 and 2006. Between 2004 and 2006, the peak period of property flipper participation in the Cook County housing market, flippers realized higher returns than longer term house holders. During this period, the presence of flippers led to general price increases in local housing markets, but also to higher levels of price instability. From 2007 to 2010, when Cook County house prices were in decline, property flippers saw prices decline more dramatically than long term holders, and the presence of property flippers could potentially pose much more risk to neighborhood housing market stability.