After aggressively entering the housing market in 2012, institutional investors slowed their purchasing of single family homes in early 2014, signaling the beginning of a new phase in the real estate owned (REO)-to-rental cycle that shifts focus away from property acquisition and increasingly toward how these global corporations will act as property owners and managers of scattered site single family rental homes. Given the concentrated geographic patterns of institutional investor buying, certain municipalities and neighborhoods whose housing markets may have benefited in the short-term from large-scale investor purchases could also be more impacted by decisions made by these investors.

This blog post uses data from IHS’s Data Clearinghouse to highlight the buying patterns of one large institutional investor and show the block-level buying patterns in areas where this institution was particularly active and where impacts from these investors' decisions would be felt most acutely.

Institutional Investors

As explored in a previous IHS blog post on the issue, the last two years saw significant growth in the presence of institutional investor buyers in the single family REO-to-rental industry nationally and in Cook County. These investors targeted the large inventory of distressed single family homes in areas that exhibited growing demand for rental housing and potential for price appreciation. It is estimated that institutional investors purchased as many as 200,000 single family homes nationwide, spending $20 billion since the beginning of 2012.

IHS analysis also showed that institutional investor purchases in Cook County have been led by one entity: the Blackstone Group, one of the world’s largest private equity firms. In 2013, Blackstone acquired more than 1,300 single family properties in Cook County. Their purchases were also geographically concentrated in certain neighborhoods in the City of Chicago and in select municipalities in suburban Cook County.

During the earliest stages of Cook County’s housing recovery, purchases by institutional investors likely helped to stabilize prices in areas where was no other demand for single family homes from individual homebuyers. In early 2014, however, foreclosures slowed and house prices continued to increase, reducing the inventory of low-priced, distressed properties available to investors. Many of the leading institutional investors signaled that their single family home buying spree was over or had shifted to a more targeted acquisition strategy in a few key markets. In the first quarter of 2014, purchases of single family homes In Cook County by the largest investors were down 63 percent compared to the same time in 2013 according to IHS analysis.

Neighborhood Concerns

As institutional investor buying slows, the short-term, positive price stabilizing effects on local housing markets may fade as large investors embark on a new model of holding and renting these homes for an unknown period of time with unclear disposition strategies. Institutional investors are new players in this field, and the management of scattered site single family rental homes is logistically difficult. These challenges are further complicated by variation in local laws governing property maintenance and management should a portfolio span multiple jurisdictions. While it is possible that global corporations can bring improved technology and resources to increase the effectiveness and efficiency of scattered site property management, there are also concerns that the priorities of these entities may not be in line with municipalities and renters. These concerns are amplified by the growing popularity of securitization of single family rental housing which further removes decisions on property management and disposition strategies from local players and into the hands of global corporations.

Blackstone in Cook County Communities

Communities that may be most impacted by property management and disposition decisions made by institutional investors are those towns, neighborhoods, or even blocks where institutional investor buying has been particularly concentrated. In particular, if one large corporate entity owns a substantial share of single family properties in a neighborhood, decisions made by that entity could have a dramatic impact on those local housing markets.

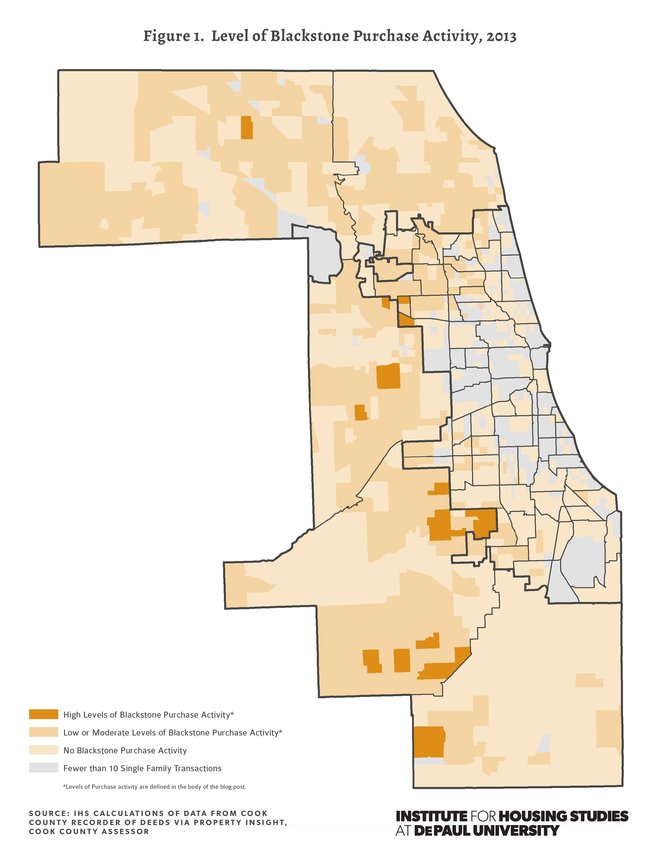

To illustrate areas where decisions made by institutional investor owners may have the biggest impact, IHS used data from property sales records to map out areas where Blackstone affiliated entities, THR Properties Illinois, IH2 Property Illinois, and IH3 Property Illlinois were particularly active buyers in 2013.

Figure 1 maps the census tracts in Cook County with the highest concentrations of Blackstone purchasing. The darkest areas highlight the 21 census tracts where Blackstone purchased 10 or more homes and also accounted for at least 10 percent of all single family transactions in 2013. Lighter tracts show areas where Blackstone’s purchases accounted for less than 10 percent of single family sales or fewer than 10 total sales in 2013. The lightest areas are those census tracts were Blackstone had no single family purchases in 2013.

Figure 1. Level of Blackstone Purchase Activity, 2013

Figure 1. Level of Blackstone Purchase Activity, 2013

Drilling down further, the following maps illustrate block-level buying patterns in some of the high-concentration census tracts highlighted in Figure 1.

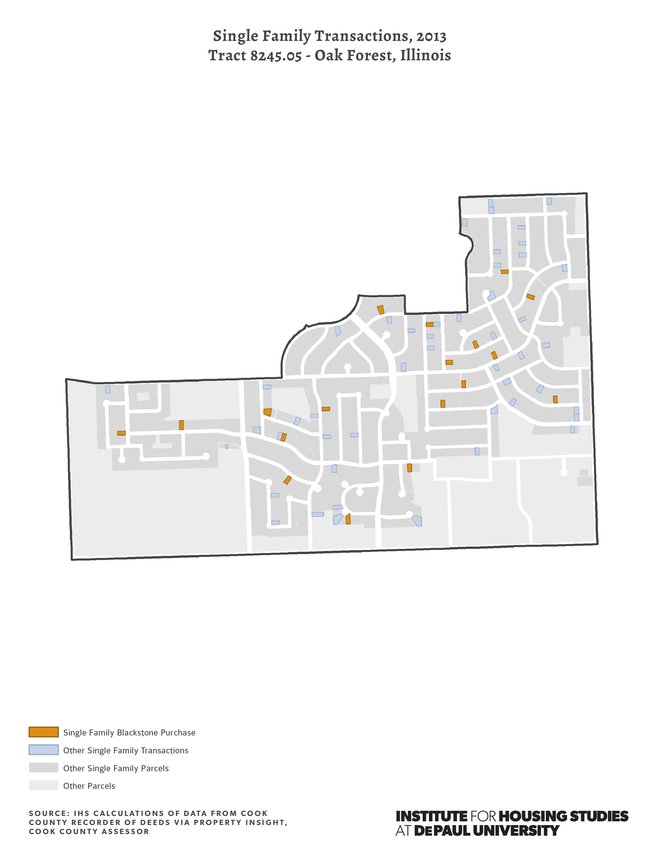

Figure 2 looks at a census tract in Oak Forest, a suburb near the southwest side of Chicago. Blackstone purchased 58 single family properties in Oak Forest in 2013, accounting for 18.2 percent of all single family sales. In the census tract within Oak Forest shown below, Blackstone’s buying was even more concentrated, purchasing 18 homes and accounting for 28 percent of all single family sales.

Figure 2. Oak Forest Single Family Transactions, 2013

Figure 2. Oak Forest Single Family Transactions, 2013

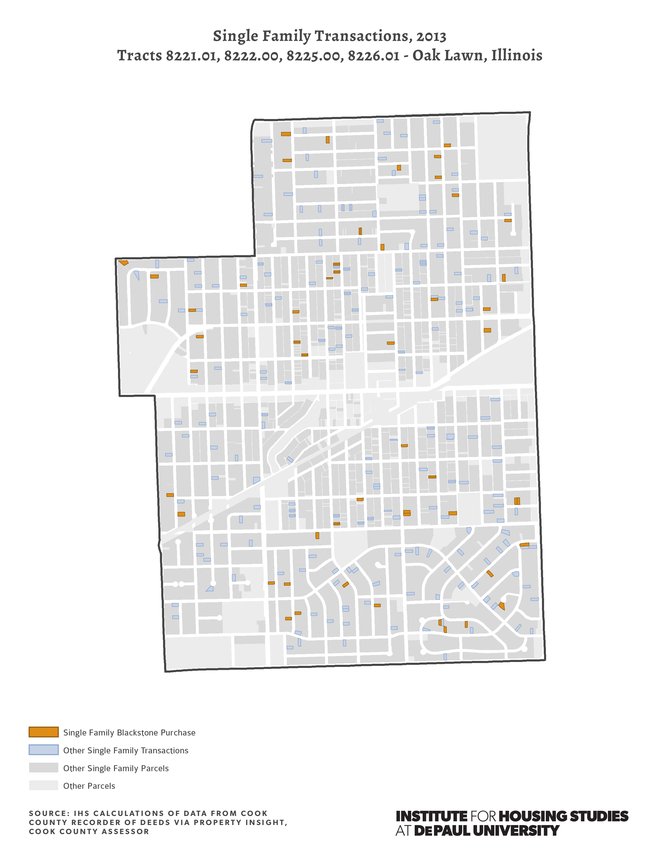

Figures 3 and 4 show patterns of concentrated buying of single family properties by Blackstone in two other Cook County communities: one in the southwest suburban Cook County community of Oak Lawn and one in the City of Chicago Community Area of Austin. Figure 3 shows purchases by Blackstone in four adjacent census tracts in Oak Lawn. Blackstone purchased 111 single family properties in the community of Oak Lawn in 2013, accounting for 15.5 percent of all single family sales. In the four Oak Lawn census tracts shown below, however, Blackstone purchased 59 homes and accounted for 20.2 percent of all single family sales.

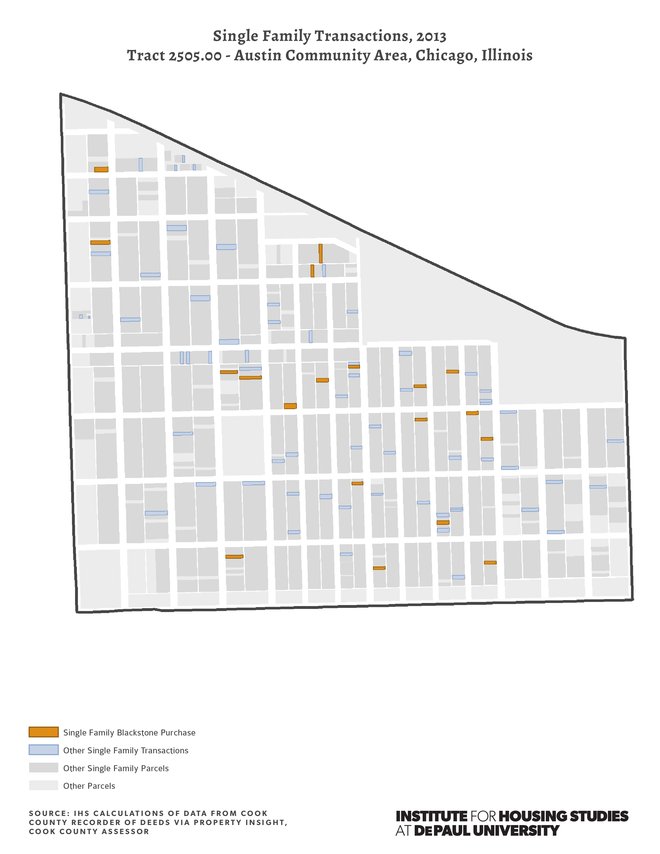

In the Chicago Community Area of Austin, Blackstone purchased 19 single family properties, accounting for 5.5 percent of all single family sales. However all of those purchases were in the Austin census tract shown below, located in the Galewood neighborhood, where the 19 homes Blackstone purchased accounted for 22.4 percent of all single family sales.

Figure 3. Oak Lawn Single Family Transactions

Figure 3. Oak Lawn Single Family Transactions

Figure 4. Austin Community Area Single Family Transactions, 2013

Figure 4. Austin Community Area Single Family Transactions, 2013

Though it is too early to tell what the implications for communities with this level of market share by one institutional investor may be, potential concerns include those related to the stability of local housing markets, as well as the affordability and quality of homes for potential renters. While institutional investor buying may have stabilized house prices in some local housing markets, long-term concerns may exist in communities highlighted above where institutional investors like Blackstone are particularly active.

To be notified about new reports as well as new blog posts, and to give us feedback, follow us on Twitter, like us on Facebook, and join our LinkedIn Group.